Background

The COVID-19 virus heightened fears of contracting and spreading a deadly disease to others. We have become aware that touching surfaces and being too close to others can cause viruses to spread.

Bank ATMs were not originally designed with this in mind and require the user to touch the screen and pin pad in order to do a simple transaction like withdrawing money.

Problem

When I reviewed the videos of the cash withdrawal from the ATMs of all the 5 major Canadian banks, I noticed that they all used the same touchscreen technology.

The touchscreens produced glare and finger marks could seen on some of them. All ATMs are in proximity to a window so people had to contend with glare on the screen on a sunny day.

Every transaction with entering your bank card into the slot followed by a prompt to enter your PIN number to log in to use the machine. The user are encouraged to cover their PIN to protect it from anyone, which meant their had to get closer to the screen and pin pad.

The user would then have to touch the touchscreen (or the buttons on the side of the screen) in order to complete a transaction. In total, a user had to touch the machine at least 6 times to get cash.

This experience is not safe, slow, and could be improved.

User Research

Videos were taken of real people withdrawing money from an ATM from each of the major 5 Canadian banks.

A heuristic analysis was drafted of each video and personas were created to help find a north star to guide the project.

Persona

Josie is a 65 year old recently retired factory worker who held many speed records at her former company. She has 2 grandchildren and loves spending time with them. She is in the high risk if she were to contract COVID-19 and so she needs stay away from any possible sources of the virus. She has low vision and English is a second language.

Behaviours

She has an iPhone and uses it everyday to listen to music, communicate on Facebook / WhatsApp. She continues to go to branch to do all her banking, however. When she withdraws money she has set a "Fast Cash" setting to withdraw $200, in all $20 denominations, and to print her receipt. It was set by her banker and she never changed it since.

Motivations

She loves the convenience of "fast cash" and it makes her more loyal to her bank. She believes she can do anything others her age can do. She has learned how to tap her credit card for purchases from looking at her peers. She requires a bit of help with setting things up on her phone. Once set up by her children, she beleives that she can start using Apple Pay.

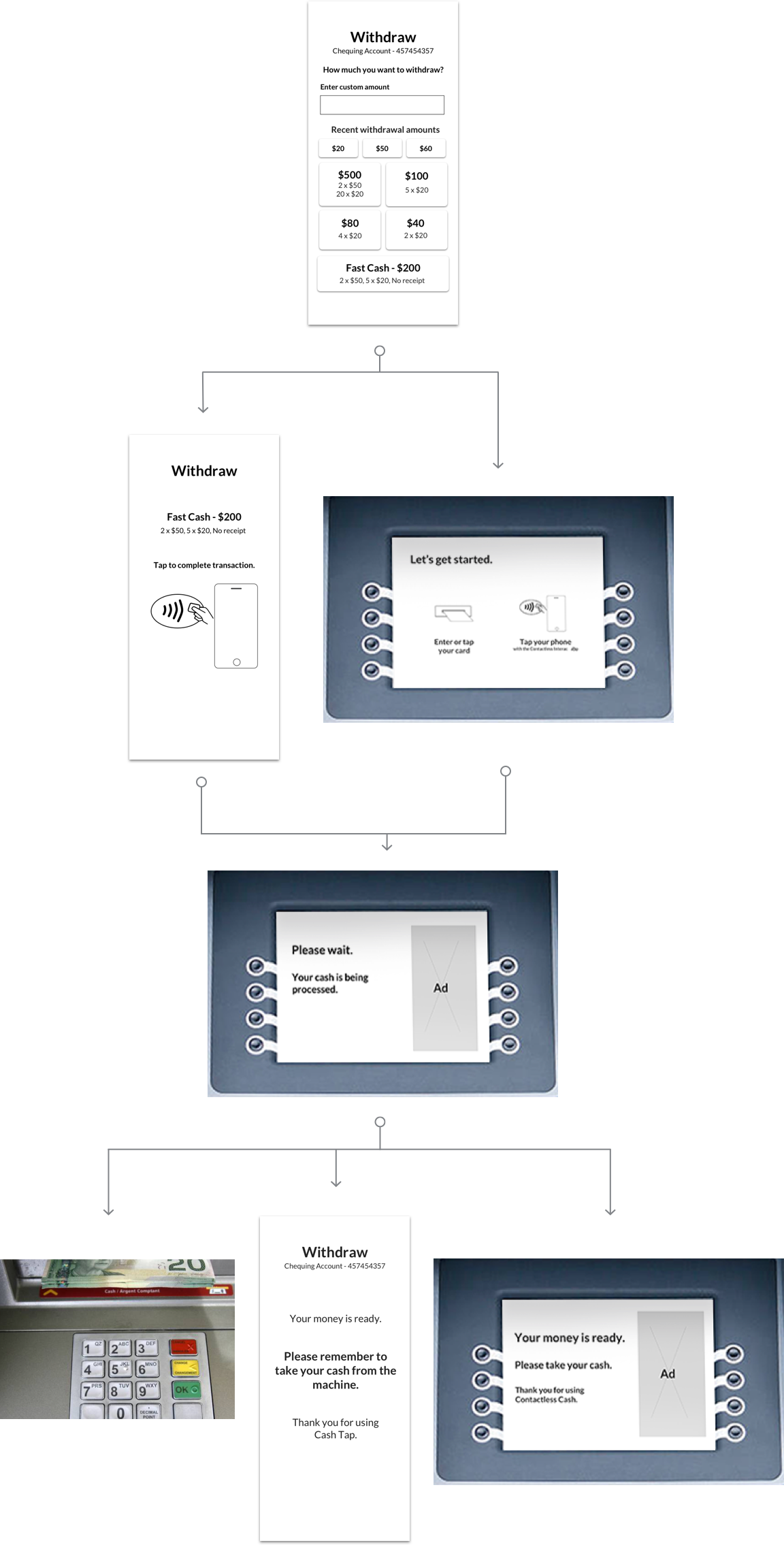

Final Design

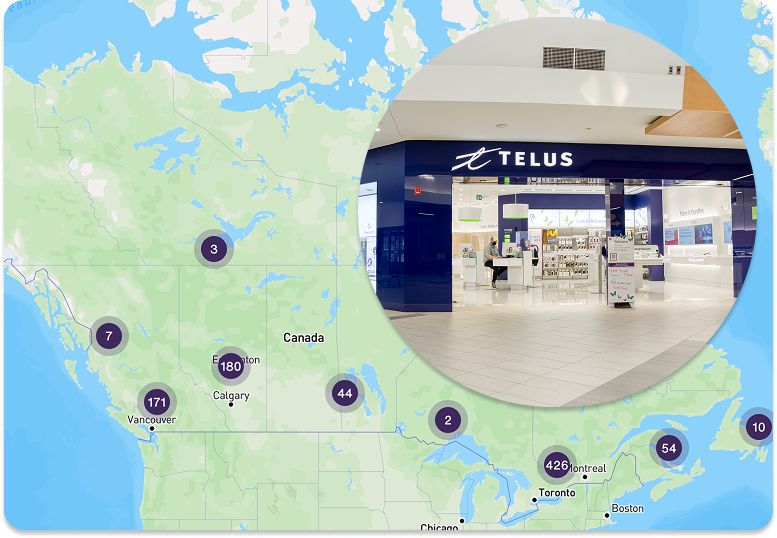

For the final design, I applied the newly launched Telus Design System. It was designed to create a friendly look and feel and provides a clean consistent visual language across all Telus brands. Its purpose is to communicate the holistic brand promise of Telus and when applied to an ATM screen it immediately becomes apart of the Telus family.

Concluding Thoughts

Another possible benefit of a contactless flow is that users shouldn't need to hide their PIN to possible onlookers. They might not even need to remember a separate 4-digit PIN for the ATM if the banking app has already identified them (ie using biometric identification or an online banking password).

This process also allows the user to be in front of the ATM for less time as they did most of the selections ahead of time on their device. There should be less line ups at ATMs as a result and less exposure time to any germs in the room where the ATM is located.

We were in the middle of a pandemic and it really highlighted how hard it would be to do guerrila research (ie: just going up to a random person and ask them to participate in your research study). We are also dealing with people's money and secure bank account information.

This prototype was created in May 2020. It seemed that at the time no banks in Canada (and possibly in North America) had released a fully contactless cash withdrawal feature.

From my research, these two US banks were promoting their new “cardless” feature as contactless:

- Chase Bank - the user needs to touch the screen to select a receipt type in order to complete the transaction (get money to come out)

- Bank of Hawaii - need to touch screen to show a QR code to scan